[vc_row][vc_column][vc_column_text]

Fund Management is a funny business. A person who wants his money to be managed, always cries about the management fees the fund manager (PMS) is charging. The mutual fund investor cries about the fund management fees. The messiahs of small investors keep on showing how much money the fund manager will take if he gives this much return in this much period and so on.

Well, just like any other decision making process, the decision of whether you should ask someone to manage your equity investments is a matter of few very simple steps.

Steps

Decide what is it that you expect from equities as an asset class (Long term returns?). The word ‘long term’ is butchered a lot. Even the calmest and most patient of the people think they can handle long term easily but they cannot. Don’t fool yourself into believing that you can do 20-30 years without bothering much, especially if you depend on the money that you are putting in. Our brain plays tricks beyond our control. That’s one reason, I believe, that even if you are a fin-champ and lack the necessary psychological temperament, you should not be in the equity markets.

Once you have decided how much is it that you want, ask yourself if you can make it yourself. Not ‘CAN’ as in intellectual capacity, but given all the constraints you are investing in, can you achieve that number? The reason you should be looking for someone else is only when you think that fund manager, post his fees for managing and profit sharing, can make you more than what you can make yourself in your current capacity.

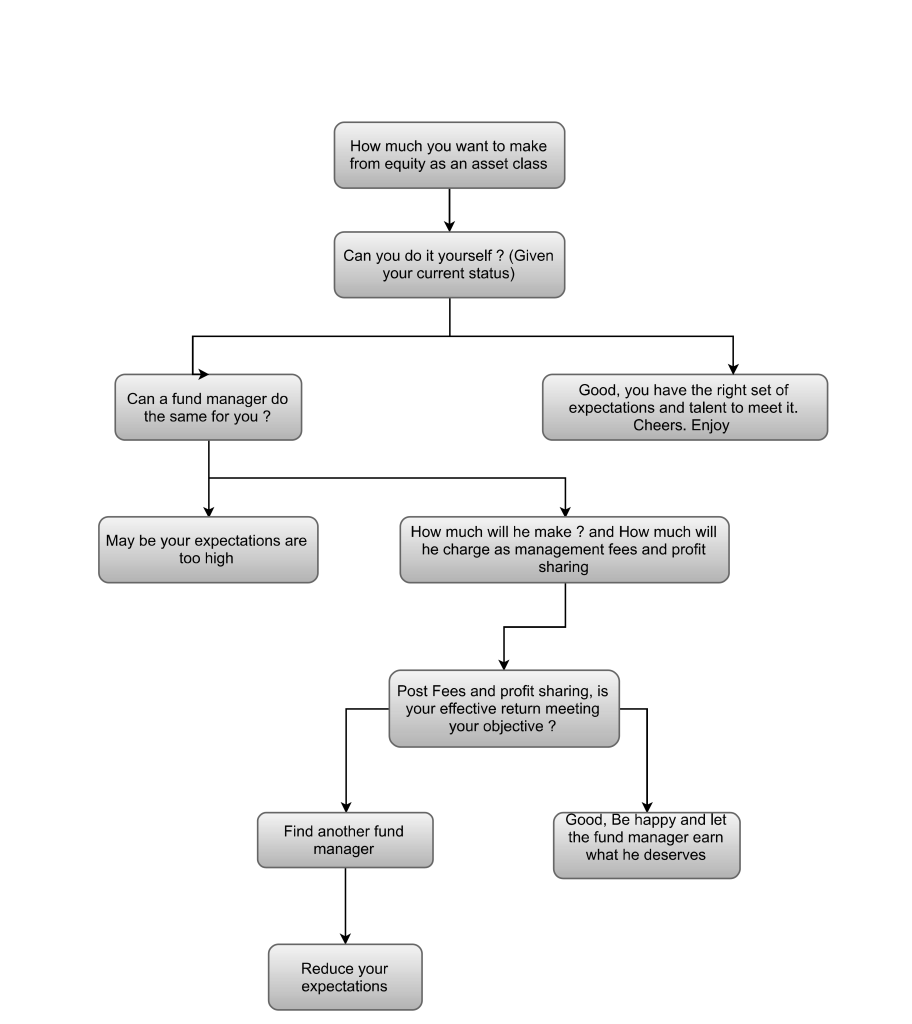

If you find such manager, just invest and let the manager make the money he deserves. It’s pretty simple. No big mysteries here. Here is a simple flowchart you can follow:

It all boils down to simple mathematics.

There are only few variables

- Expected CAGR from the manager?

- What is the invest-able time period?

- What is the hurdle rate he is offering?

- What is the profit sharing he will take after meeting the hurdle rate ?

- What is the risk free return you can make easily without hiring the fund manager?

Do the maths yourself and you will be able to figure out.

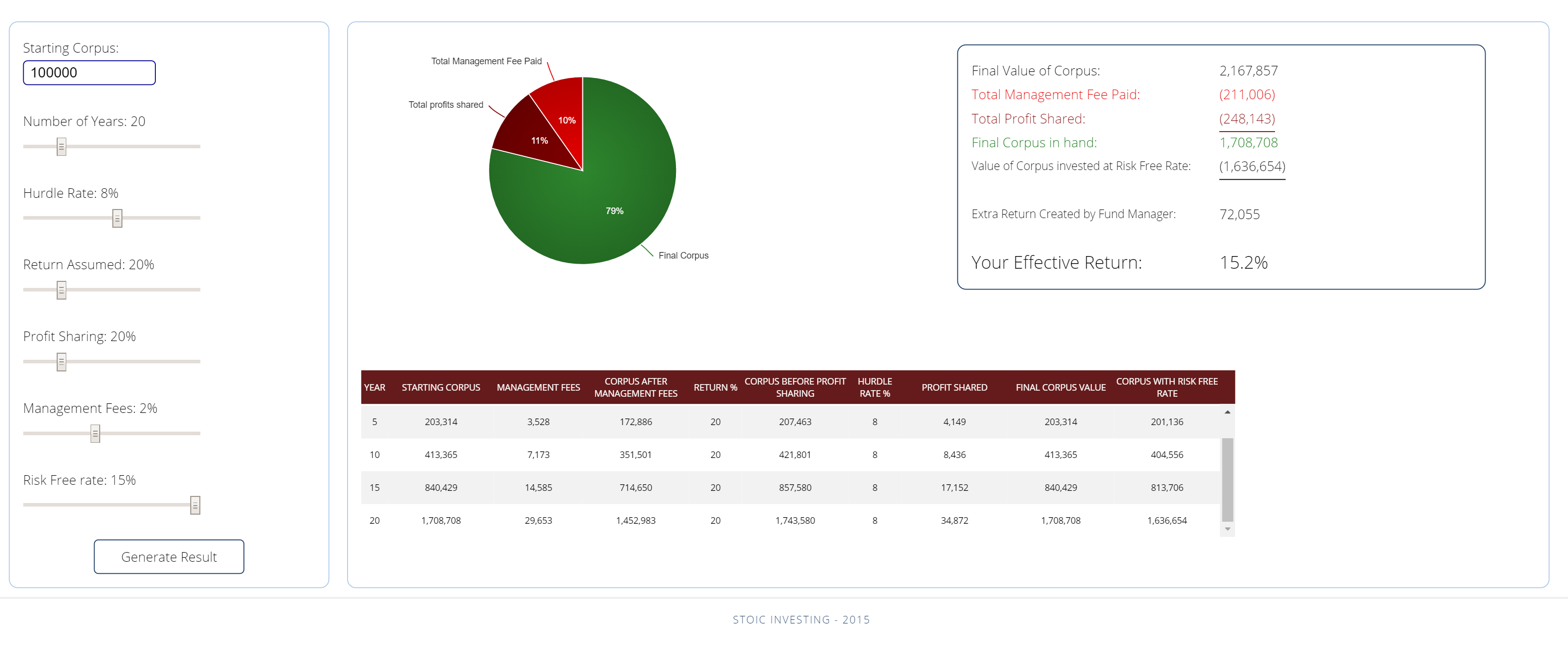

For the ease of doing the maths, we have made a simple tool which we call FUND MANAGEMENT BS METER

You might fight it counter-intuitive but if you can make 15% CAGR yourself (not very difficult), it doesn’t make any sense to pay a 2-8-20 model ( Management Fees- Hurdle Rate- Profit Sharing) model to any PMS manager who will make 20% CAGR for 20 years.

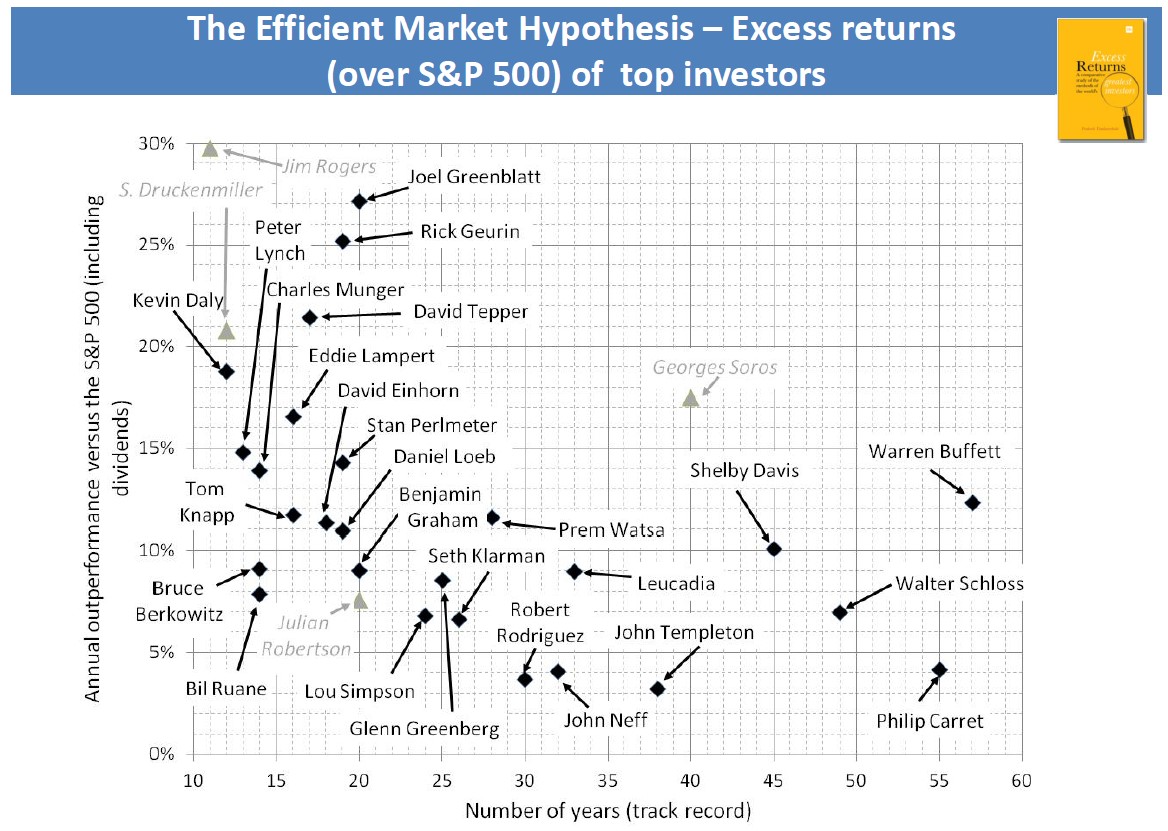

Just to put in context 20% CAGR for 20 years is a feat not many people are able to beat despite having amazing individual years of over 100% also because the draw-downs in 2-3 years is enough to level out those seemingly high returns.

The longer the time frame, more difficult it is to maintain the CAGR.

Have a look at this and you will get an idea:

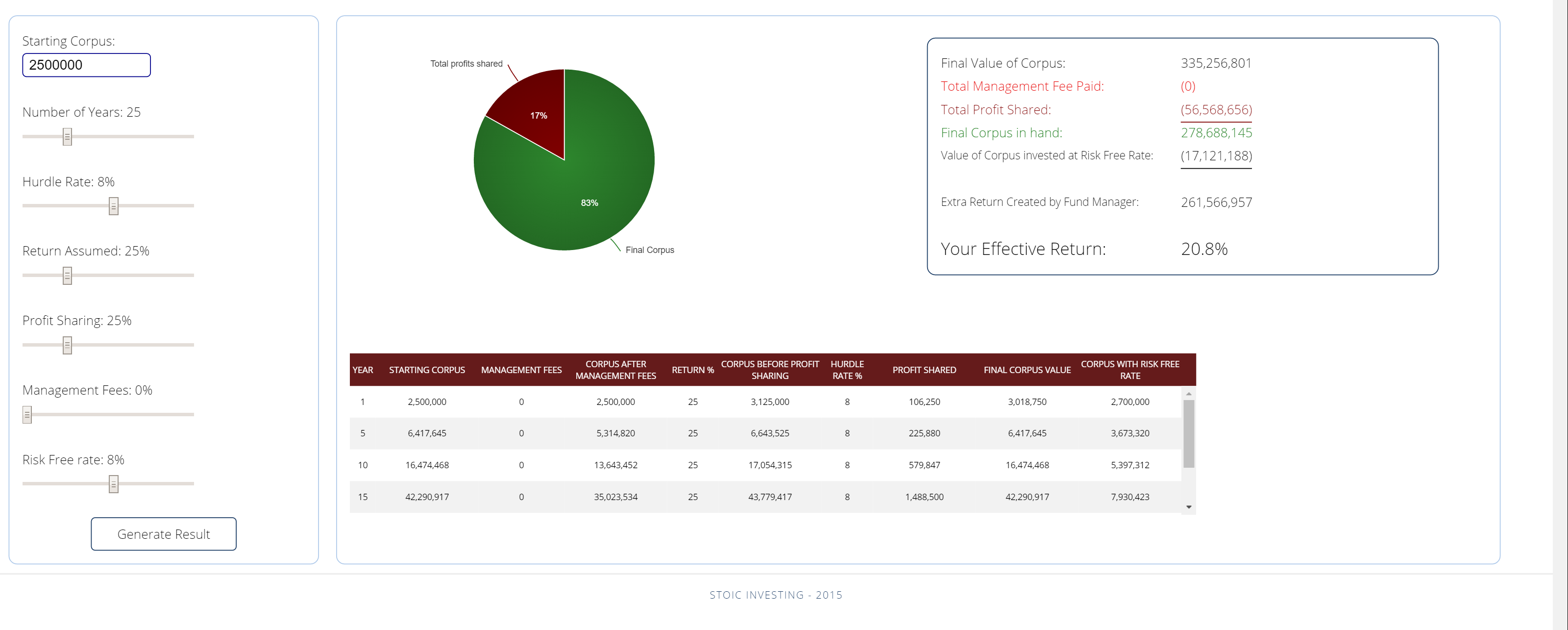

Has someone told you that 2% management fees and 20% profit sharing is better than 0% management fees and 25% profit sharing ? (because 2 +20 is 22 or some weird reason ? )

Here is how much of a difference it makes

So here it is: The Fund Management BS Meter. Calculate your effective returns. If a fund manager is looting you, find it out exactly how. Which fund manager is better in terms of sharing arrangement? etc etc. All questions can be answered using this simple tool

[/vc_column_text][/vc_column][/vc_row]