At the start of my investment career, few thoughts which made obvious sense to me were received from few amazing resources of knowledge. Besides the usual Buffett letters and Graham’s Security Analysis and many other books, a favorite of mine was ‘Common Stock and Uncommon Profits’. Philip Fisher always referred to Scuttlebutt ( Original term for a Ship bucket where sailors would meet to discuss latest gossip of the sea) as the main edge of investors who are relentlessly looking for the information on the ground to create the edge over so called ‘Armchair Investors’. I observed that even though it was commonly referred to by most of the investors, the quality of this activity was not great and thought of penning down my thoughts on the same. There have been countless articles written on the theory of it and hence I will refrain from that. I will write few practical issues I faced and how I learnt the art of scuttlebutt but that’s for later.

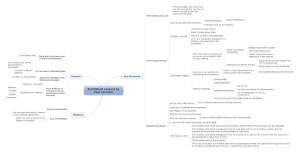

Thankfully , my job is made very easy by Miguel Barbosa of Simoleansense. He recently conducted an interview with Paul Lountzis where Paul explained the process of Scuttlebutt with great panache and infectious passion. I immediately made notes of few key points and thought of sharing the same with the readers. It benefited few of my twitter followers, hope this benefits you too. The picture is attached below. In case you use mindmap software, please download the file here.

Thanks. Happy Investing.

Very nice article . As E-commerce is talked a lot now a days , I feel Paper sector (Kraft paper is used for packaging) can gain a lot . U r view please

Thanks

Yes, Sridhar. You are on right path in thinking about the sector like Paper specifically in context of the second line beneficiary to ecommerce. Other such sector is logistics. I haven’t looked at the sector specifically and also given the SEBI laws, I refrain from writing about companies on blog but you can drop me an email for more one to one discussion.

Yes, Sridhar. You are on right path in thinking about the sector like Paper specifically in context of the second line beneficiary to ecommerce. Other such sector is logistics. I haven’t looked at the sector specifically and also given the SEBI laws, I refrain from writing about companies on blog but you can drop me an email for more one to one discussion.